How Bookkeeping Makes Your Small Business More Profitable: Resources

Wow, we covered a lot of information in the last month. And for all that we did cover, there’s so much more information that we could have given you… but it would have been difficult to understand it all at once.

Profitability, in theory, is simple, but in practice, it takes time to understand and even more time (and plenty of energy) to apply your knowledge to your small business.

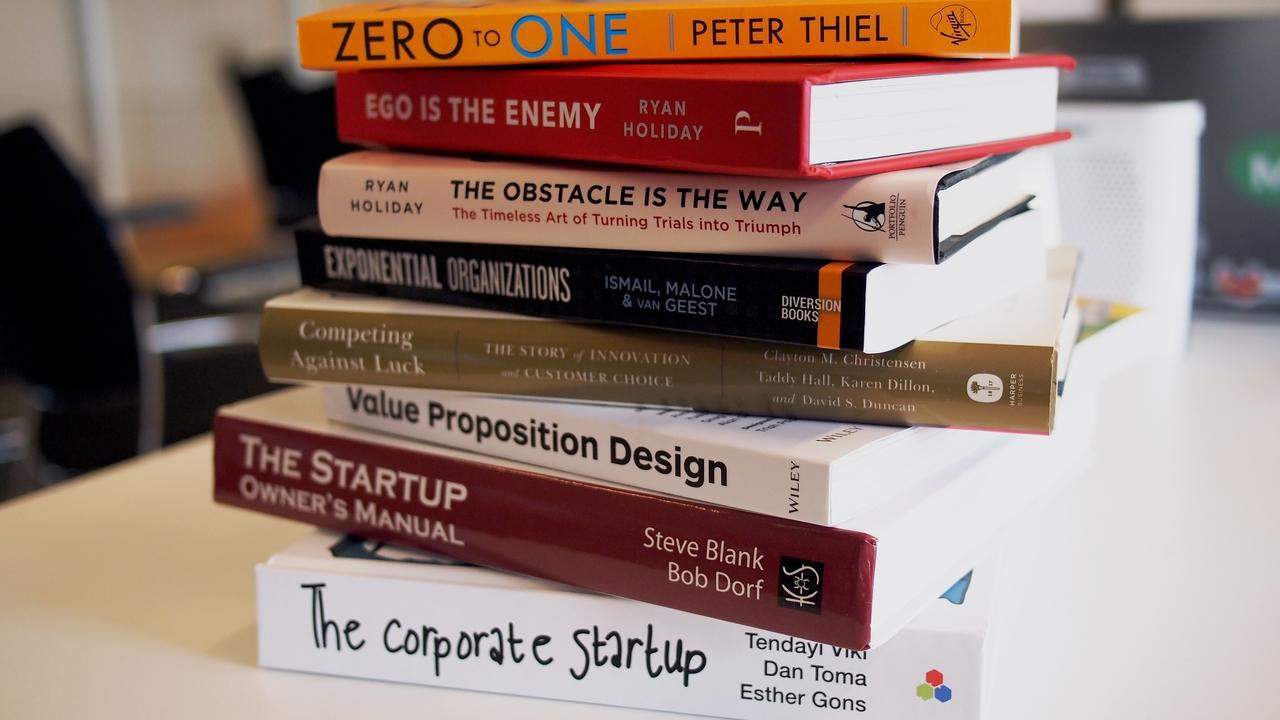

Let it never be said that we left you high and dry! We’ve got some wonderful resources that we use ourselves and also use with our relatively diverse set of small business clients.

Profitability Review

As we know by now, profitability isn’t just in the numbers, profitability is much more of a measure of your efficiency and ability to grow. More specifically, profitability is a measurement of how much profit you can make with a given set of resources and inputs.

We know that having a firm grasp on your expenses is the first step to understanding how your business is creating profit. You...

How Bookkeeping Makes Your Small Business More Profitable: Profits and Long Term Planning

So you’re making money and you’re happy… but what do you do next? Let’s discuss how you can use your net income to further your own profitability and lay the groundwork for long-term success!

Managing Profits and Savings

If you made it this far with no debt, you should not only pat yourself on the back, maybe you could tell us your secret - but for most small businesses, the first few years are more about staying afloat and learning the ins and outs of your new dream job.

Most of us have borrowed in some form or another to make sure we had the cash flow to maintain our business during its infancy. Now that we have secured net income and we understand how to make our services profitable - we can focus on managing our money efficiently!

If coming up with a Debt Reduction plan wasn’t part of your process for understanding your business expenses, than now is the time to do it! Pay from the highest interest rates first - these will also help free up your emotional energy so...

How Bookkeeping Makes Your Small Business More Profitable: Knowing your Customers and Increasing your Profitability

If you’ve been keeping up with our recent blogs you’ve already learned the foundation of small business profitability - your expenses and your income. Now it’s time to expand on this foundation to create sustainable changes in your business that lead to long term success.

It may seem like the above covers almost everything about making your small business more profitable, and we did cover a lot of very important things that will make you a smarter business owner, but there’s even more you can do to create an efficient and profitable business!

Knowing your Customers

Love, hate, or something in between, you need your customers for your small business to thrive!

When you’re just starting out, you’re thankful to have any clients, and you probably aren’t worried about retention or sales trends. But now, you’re smarter and you understand the money flowing in and out of your business - so it’s time to take your small business from successful to supreme.

So how do you go ab...

How Bookkeeping Makes Your Small Business More Profitable: Knowing your Income

Last week we talked about how understanding your small business expenses is a crucial component in making your business more profitable. Now we’re going to build on that with what we all really think of when we think of profitability, income.

The Expense and Income Relationship

In its most simple form, your income is all the money you bring in and your expenses are all the money that goes out. Your profit, or lack of, is the difference between these two numbers.

One common phrase that we hear and say frequently is “if you want to make money, you have to spend money.”

That doesn’t mean you just need to spend a certain amount of money, you need to make good decisions about what you spend your money on so those expense result in income for your small business.

Evaluating your expenses on a regular basis is one of the best ways for small business owners to stay on top of their financial plans and, most importantly, meet their income and growth goals. Without informed ...

How Bookkeeping Makes Your Small Business More Profitable: Knowing your Expenses

Keeping your Small Business books in good order is something that we’ve hammered home to our readers over the last year - but there’s more to good business than just keeping your books up to date, in fact, that’s only the beginning!

Good bookkeeping is the gateway to making your business go from good to amazing and it will allow you to turn small successes into huge gains.

So.... What is profitability?

Well it’s not just your top line that is important. That is to say, profitability is not measured only by your INCOME, it’s more than that.

Profit is an absolute number that is calculated by subtracting the total expenses from the total income.

So your profit margin is a solid number, while your profitability is a relative one. If this sounds more like math theory than business practice, don’t worry, stick with us and we'll explain...

In the most simple sense, profitability is a metric that a company will use to determine how well they use resources to generate revenue in excess...

Small Business Guide to Low Stress, High Success: Tax Liability

Employment taxes

We typically think of taxes as a once a year rodeo. There are, however, taxes that are reported and paid on a regular basis, such as employment taxes.

If you as a small business owner have employed other individuals on an hourly or salary basis, then you are responsible for paying certain types of taxes to the government.

As an employer not only must you pay and report employment taxes to the government, you are also required to prepare W-2 forms to report wages, tips, and other compensation paid to your employees.

There are two main factors that you have to pay attention to when it comes to employment taxes: reporting schedules and the different types of taxes.

Tax Types

There are several categories of taxes that an employer is responsible for and you must make sure that you are not only withholding them, but also that they’re making it to the correct place.

As an employer, you are responsible for calculating and reporting your tax liabilit...

Rediscover your WHY

We see you... small business owners

We know how demanding and stressful and hard it is to be self-employed.

We know how exhausting, frustrating and rewarding being your own boss can be. We also know that carrying around that stress can negatively impact all aspects of your life, not just your business!

And we know that when we're stressed.... how hard it is to stay inspired and focused on your passions and goals.

So we wanted to take a minute to share with you a stress reduction exercise that we do when we're feeling completely crushed by the overwhelming weight of the responsibilities of being self-employed...

So.... Whether you started your business 10 years ago, 10 months ago, or you've just come up with 10 ideas for your first business, we want to give you some strategies that work for us when we're feeling burned out and uninspired.

Whenever we're feeling like we can't keep up our head above water, it helps for us to go back to happier times.....

So, we want to take y...

Stay on top of your 2019 Tax Season

With the regular 2018 tax season over, most of us are breathing a sigh of relief, but it doesn’t mean that we can slack off! Staying on top of your taxes is a year long process, but it doesn’t have to be a stressful one.

Whether this tax season was a breeze for your small business, or it was traumatizing and you considered the white flag, we have a way for you to keep your taxes in line and out of mind!

Estimates

How do you know if you need to pay quarterly estimated taxes?

If you are a sole proprietor, S-Corp shareholder, or self employed, you generally have to pay quarterly taxes.

If you will owe $1000 dollars or more in taxes, you should definitely be paying quarterly tax estimates.

Why do we pay quarterly and not just once a year?

This cuts down on penalties from the IRS. It also allows your small business to plan accordingly for four smaller expenses instead of one large yearly expense.

Withholding

If you are an employee or if you have employees, anot...

Top 7 Tips for a Stress Free Tax Season

Tax season is stressful even when you’re prepared for it, but it’s downright overwhelming when you aren’t. Piles of paperwork, deadlines, and the fear of not knowing how much you might owe can make the most shrewd business owner consider procrastinating until the last minute, we know, we’ve considered that one-way ticket to Kauai too.

Never fear, we’ve compiled some great advice to help you climb that tax mountain and find your sweet return at the top!

1 Know your Deadlines

If you know when you need to have things done by, planning them out is easier. Here are the most important tax deadlines that you should know about:

- January 31, 2019: File forms 1099 for non-employee payments you made of over $600.

- March 15, 2019: Partnerships & S-Corps must file by this deadline and provide K-1 forms to partners or shareholders.

- April 15, 2019: Individuals and Corporations must file their 2018 taxes. The 6-month extension and first payment is also due on this day.

...

2018 Tax Reform and How it Affects You

The tax law reform that went into effect in January of 2018 was the biggest reform passed in the last 30 years. It will affect both individual and business returns in multiple ways.

If you’re curious as to how these laws may change your tax return, we have you covered!

Changes for Individual Taxes in 2018

There are several large changes that you’ll be seeing this spring on your tax return, and some are more noticeable than others.

The Racket About Brackets

For 2018 the tax brackets have seen significant changes that will affect how much you owe compared to the previous year.

These rates will change again for 2019.

Exemptions and Deductions

Personal and Dependent deductions, the per person deductions of $4050 on your 2017 return, have been suspended, and will not be appearing on your 2018 return.

However, the standard deduction has been significantly raised.

For healthcare, the allowable medical deduction floor has been temporarily lowered from 10%...