Year End Tips and Tricks

Can you believe that 2018 is almost done??!

We certainly can’t! It doesn’t seem to matter how organized your are, when you have a lot of stuff to do, it’s almost like time passes faster. And since I’d get in trouble if this blog became a discussion about relativity, we’ll skip to the good part and cover 4 Tips and Tricks to help you make sure your books are where they need to be!

4 Ways to Ensure your Books are Ready for the New Year

If you’ve kept up with our blogs throughout 2018, you might be familiar with some of these tips, but that won’t make them any less useful.

Whether you’ve mostly kept up with your books for the year, or you’re staring down multiple months of transactions, read on for some ways to save your time and sanity!

1 The Chart of Accounts

Your Chart of Accounts, or CoA, is your friend! It contains all of the categories that you use to keep your bookkeeping records as well as the Bank accounts you use. If you need more information on the CoA and other bookkeeping basic, go here!

At the very least, your CoA should be tracking:

- Your income

- Your expenses

- The checks you write

- The deposits that come into your bank account

If this seems confusing, we’ve got two ways to help!

First you can download our sample CoA HERE.

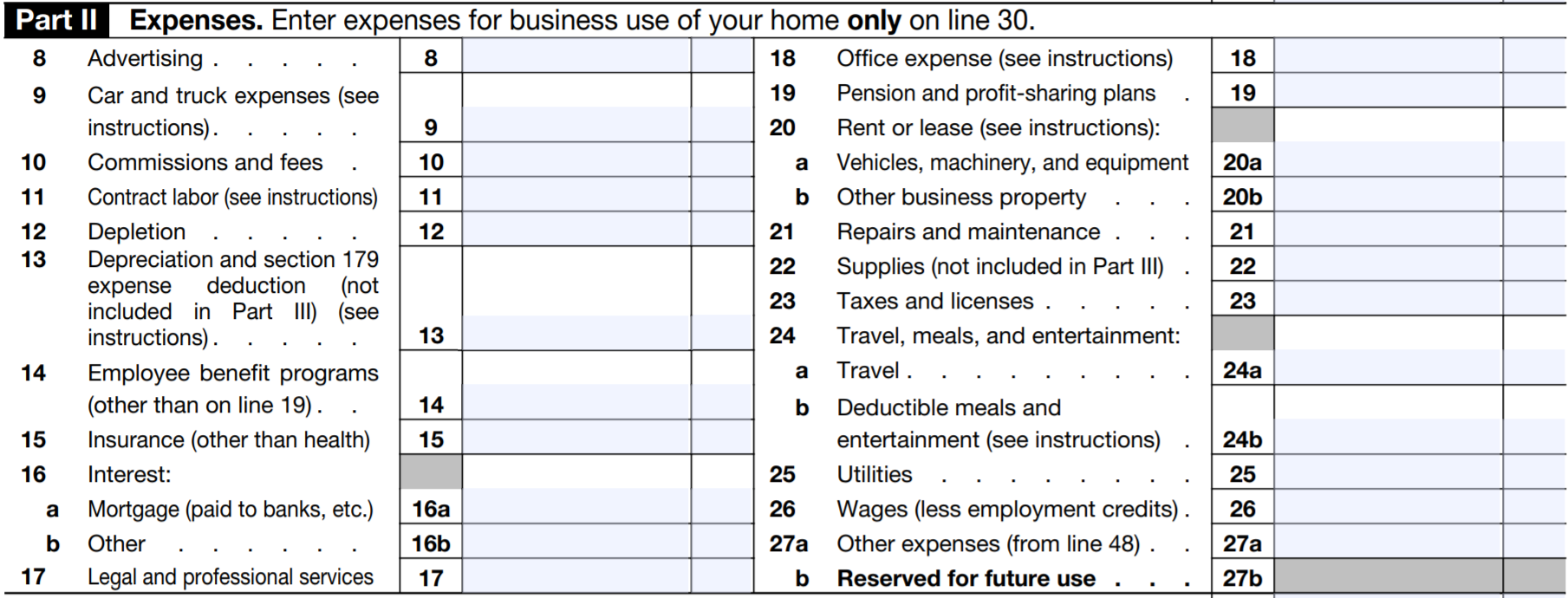

Second, the best guide for how you should categorize your books is actually your tax form. The IRS will only ask you for your total income and give you about 20 pre-populated categories for expenses on your schedule C or business tax forms. Since you’re keeping your books in part so that you can pay your taxes, modeling your books around your tax forms is a great step! See below for the schedule C list of expenses!

2 Get Organized

Are you drowning in paperwork? Can you not find that one document you need? Choosing a storage system for all of your important paperwork can save you a bunch of time and hassle!

You have the option of digital storage, where you scan your documents and store them on your own computer or pay for access to secure cloud storage. This is our personal preference, as it allows you a lot more flexibility with when, where, and how you can work.

If you aren’t comfortable with that, you can come up with a filing system that works for you and your business. Don’t forget that you need to store most of your documents for 7 years to be safe!

![]()

3 Recording Expenses

Every business has expenses, you can’t avoid paying for the things that you need!

Hopefully, you're not exactly like me, the person with a month of receipts sitting in their purse that need to be sorted out. Even if you are, there are some really great and fast ways to get through all those purchases and into the clear!

It’s not time efficient for you to go into your books and categorize every expense when it occurs, so you need a way to keep your receipts handy for when you do categorize things. As we mentioned above, scanning them is definitely an option, and you can even attach the scanned receipts to the transaction in Quickbooks Online!

If scanning isn’t your preference, we highly recommend getting some blank envelopes and using them for storage. Label each envelope with the basic expense category (office supplies, gas, meals) and then put your receipts into the correct envelope as you go! It helps to keep a running tally of expenses on the envelope for quick reference, but you don’t have to do that if you’re in a hurry!

For a more in-depth look at organization and document retention, check out our blog on Document Management and the "Document Storage" section of our Resources Page!

4 Bank Reconciliation

There is very little point in keeping financial records for your business if you can’t make sure that they are correct. That’s where the Bank Reconciliation comes in!

Bank reconciliation allows us to ensure that our records are accurate. Accurate records mean that we get the most deductions on our tax return and that we can make informed business decisions to grow and manage our business going forward. Here are some reconciliation tips to keep in mind when you’re dealing with your own books:

- Dates - dates affect what entries show up, if you enter a date incorrectly on an expense or income payment, it might not show up in your reconciliation screen!

- Duplicates - sometimes one transaction can be entered multiple times. Always check for duplicates when you can’t reach a zero balance in your reconciliation screen

- Starting Balance - when you reconcile, the first thing QBO will ask you to do is enter the ending balance for the time period that you are reconciling. If your starting balance is off, you can’t do this! Your starting balance will be off if you have changed or deleted previously reconciled transaction. QBO will prompt you to view a report that has a list of transactions that were changed since they were reconciled.

Now get out there and seize what’s left of 2018!

We Hope to See You Soon!

With the rapid onset of the holidays, we know that everyone is supremely busy this month! Please find time for yourself and some stress relief during this busy season, and check out our Best Blogs feature coming next week! We'll recap the best blogs of the year and share our favorite warm drink recipe!

Disclaimer This article presents general information and is not intended to be tax or legal advice. Refer to IRS publications and discuss possible tax deductions with your tax preparer.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.