Business Deductions, Without the Guesswork

Business deductions shouldn’t feel confusing, but many owners find themselves second-guessing them every year. The problem usually isn’t that anyone is doing something shady. It’s that deductions feel intuitive, and the rules are not.

Spending money in your business is easy. Deducting it correctly takes a little more intention. Once you understand how the IRS actually looks at expenses, deductions become far less stressful and much easier to handle with confidence.

Let’s walk through how deductions really work, where people tend to get tripped up, and how to approach them without overthinking it.

Why Payment Method Doesn’t Matter

Using a business bank account or credit card does not automatically make an expense deductible.

The IRS doesn’t care how you paid for it. They care why you paid for it.

Every deductible expense has to be ordinary for your work and necessary to run your business. If it exists mostly for personal reasons and just happens to run through the business, it usu...

What Your Accountant Needs From You This Tax Season

Tax season rarely goes off the rails because of complicated tax law.

It usually breaks down because of missing information, slow responses, or assumptions that someone else is handling it. A smooth tax season is less about perfection and more about being prepared and responsive.

Show Up Early

Even in a digital world, you cannot disappear and expect your accountant to magically fill in the gaps. You have to raise your hand and say, I’m ready.

That might be a quick email, a short call, or a scheduled drop-off. The goal is simple. Let your accountant review what you have and tell you early if anything is missing.

That one step can save weeks.

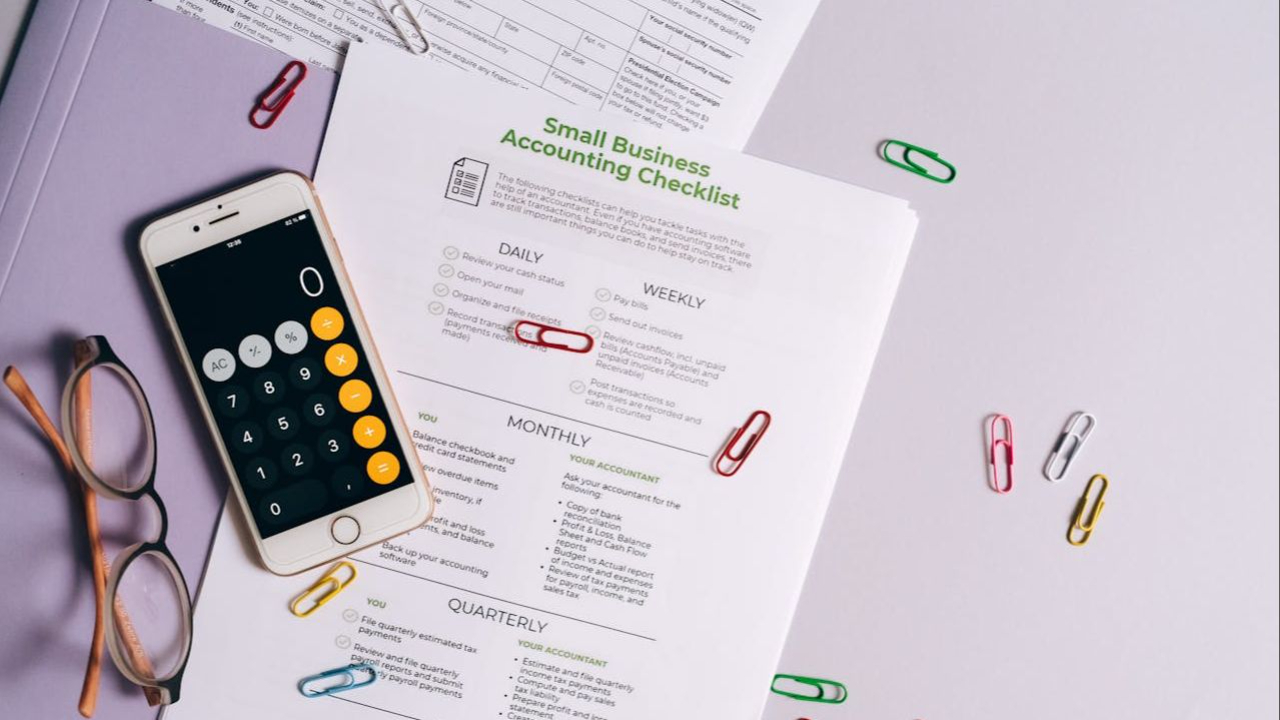

Bring What Matters

Your accountant does not need every document you have ever touched. They need clean, complete financials.

Start with:

A full-year Profit and Loss statement, ideally compared to the prior year

A full-year Balance Sheet, also compared to the prior year

Make sure bank and credit card accounts are reconciled.

Then include ta...

A Better Way to Start Tax Season

Most business owners think tax season starts in March or April. That’s why tax season ends up feeling chaotic. In reality, there are many things to be done in January that will set things up for a more manageable tax season.

What you do this month determines how much time, money, and energy taxes will take later.

Why January Is More Important Than You Think

January may feel disconnected from tax season, but for business owners it sets the tone for everything that follows. What you do this month often determines how smooth or stressful tax season becomes.

By the end of January, W-2s must be issued and 1099s filed for qualifying contractors and vendors. 1099s especially tend to take longer than expected due to missing or incorrect vendor info, and missing these deadlines leads to avoidable penalties.

January is also when your books should be finalized. Bank and credit card accounts reconciled, payroll and payroll taxes confirmed, asset and liability accounts reviewed, and loose end...

What is Bookkeeping?

“So what is bookkeeping?”

Believe it or not that’s actually one of the most frequently asked questions we get. Small business owners seem to understand that it has to do with basic business finances, but what is bookkeeping really?!

Bookkeeping Basics

“Bookkeeping” is the act of recording financial transactions. Seems simple, right?

Well, wait a second, while we’re here… let’s break down the word “transactions” too, so we have the most basic building blocks of bookkeeping!

What is a Financial Transaction?

There are two general types of transactions you need to record for your bookkeeping, your expenses and your income. At the most basic level, you are recording the money that goes out of your business (an expense) and the money that comes into your business (your income).

Expense Basics

We need to record the money that goes out of our businesses so we can know what our working budget is. As a small business owner, you not only need to know how much money y...

How Bookkeeping Makes Your Small Business More Profitable: Resources

Wow, we covered a lot of information in the last month. And for all that we did cover, there’s so much more information that we could have given you… but it would have been difficult to understand it all at once.

Profitability, in theory, is simple, but in practice, it takes time to understand and even more time (and plenty of energy) to apply your knowledge to your small business.

Let it never be said that we left you high and dry! We’ve got some wonderful resources that we use ourselves and also use with our relatively diverse set of small business clients.

Profitability Review

As we know by now, profitability isn’t just in the numbers, profitability is much more of a measure of your efficiency and ability to grow. More specifically, profitability is a measurement of how much profit you can make with a given set of resources and inputs.

We know that having a firm grasp on your expenses is the first step to understanding how your business is creating profit. You...

How Bookkeeping Makes Your Small Business More Profitable: Profits and Long Term Planning

So you’re making money and you’re happy… but what do you do next? Let’s discuss how you can use your net income to further your own profitability and lay the groundwork for long-term success!

Managing Profits and Savings

If you made it this far with no debt, you should not only pat yourself on the back, maybe you could tell us your secret - but for most small businesses, the first few years are more about staying afloat and learning the ins and outs of your new dream job.

Most of us have borrowed in some form or another to make sure we had the cash flow to maintain our business during its infancy. Now that we have secured net income and we understand how to make our services profitable - we can focus on managing our money efficiently!

If coming up with a Debt Reduction plan wasn’t part of your process for understanding your business expenses, than now is the time to do it! Pay from the highest interest rates first - these will also help free up your emotional energy so...

How Bookkeeping Makes Your Small Business More Profitable: Knowing your Customers and Increasing your Profitability

If you’ve been keeping up with our recent blogs you’ve already learned the foundation of small business profitability - your expenses and your income. Now it’s time to expand on this foundation to create sustainable changes in your business that lead to long term success.

It may seem like the above covers almost everything about making your small business more profitable, and we did cover a lot of very important things that will make you a smarter business owner, but there’s even more you can do to create an efficient and profitable business!

Knowing your Customers

Love, hate, or something in between, you need your customers for your small business to thrive!

When you’re just starting out, you’re thankful to have any clients, and you probably aren’t worried about retention or sales trends. But now, you’re smarter and you understand the money flowing in and out of your business - so it’s time to take your small business from successful to supreme.

So how do you go ab...

How Bookkeeping Makes Your Small Business More Profitable: Knowing your Income

Last week we talked about how understanding your small business expenses is a crucial component in making your business more profitable. Now we’re going to build on that with what we all really think of when we think of profitability, income.

The Expense and Income Relationship

In its most simple form, your income is all the money you bring in and your expenses are all the money that goes out. Your profit, or lack of, is the difference between these two numbers.

One common phrase that we hear and say frequently is “if you want to make money, you have to spend money.”

That doesn’t mean you just need to spend a certain amount of money, you need to make good decisions about what you spend your money on so those expense result in income for your small business.

Evaluating your expenses on a regular basis is one of the best ways for small business owners to stay on top of their financial plans and, most importantly, meet their income and growth goals. Without informed ...

How Bookkeeping Makes Your Small Business More Profitable: Knowing your Expenses

Keeping your Small Business books in good order is something that we’ve hammered home to our readers over the last year - but there’s more to good business than just keeping your books up to date, in fact, that’s only the beginning!

Good bookkeeping is the gateway to making your business go from good to amazing and it will allow you to turn small successes into huge gains.

So.... What is profitability?

Well it’s not just your top line that is important. That is to say, profitability is not measured only by your INCOME, it’s more than that.

Profit is an absolute number that is calculated by subtracting the total expenses from the total income.

So your profit margin is a solid number, while your profitability is a relative one. If this sounds more like math theory than business practice, don’t worry, stick with us and we'll explain...

In the most simple sense, profitability is a metric that a company will use to determine how well they use resources to generate revenue in excess...

Year End Tips and Tricks

Can you believe that 2018 is almost done??!

We certainly can’t! It doesn’t seem to matter how organized your are, when you have a lot of stuff to do, it’s almost like time passes faster. And since I’d get in trouble if this blog became a discussion about relativity, we’ll skip to the good part and cover 4 Tips and Tricks to help you make sure your books are where they need to be!

4 Ways to Ensure your Books are Ready for the New Year

If you’ve kept up with our blogs throughout 2018, you might be familiar with some of these tips, but that won’t make them any less useful.

Whether you’ve mostly kept up with your books for the year, or you’re staring down multiple months of transactions, read on for some ways to save your time and sanity!

1 The Chart of Accounts

Your Chart of Accounts, or CoA, is your friend! It contains all of the categories that you use to keep your bookkeeping records as well as the Bank accounts you use. If you need more information on the CoA ...