Business Deductions, Without the Guesswork

Business deductions shouldn’t feel confusing, but many owners find themselves second-guessing them every year. The problem usually isn’t that anyone is doing something shady. It’s that deductions feel intuitive, and the rules are not.

Spending money in your business is easy. Deducting it correctly takes a little more intention. Once you understand how the IRS actually looks at expenses, deductions become far less stressful and much easier to handle with confidence.

Let’s walk through how deductions really work, where people tend to get tripped up, and how to approach them without overthinking it.

Why Payment Method Doesn’t Matter

Using a business bank account or credit card does not automatically make an expense deductible.

The IRS doesn’t care how you paid for it. They care why you paid for it.

Every deductible expense has to be ordinary for your work and necessary to run your business. If it exists mostly for personal reasons and just happens to run through the business, it usu...

What Your Accountant Needs From You This Tax Season

Tax season rarely goes off the rails because of complicated tax law.

It usually breaks down because of missing information, slow responses, or assumptions that someone else is handling it. A smooth tax season is less about perfection and more about being prepared and responsive.

Show Up Early

Even in a digital world, you cannot disappear and expect your accountant to magically fill in the gaps. You have to raise your hand and say, I’m ready.

That might be a quick email, a short call, or a scheduled drop-off. The goal is simple. Let your accountant review what you have and tell you early if anything is missing.

That one step can save weeks.

Bring What Matters

Your accountant does not need every document you have ever touched. They need clean, complete financials.

Start with:

A full-year Profit and Loss statement, ideally compared to the prior year

A full-year Balance Sheet, also compared to the prior year

Make sure bank and credit card accounts are reconciled.

Then include ta...

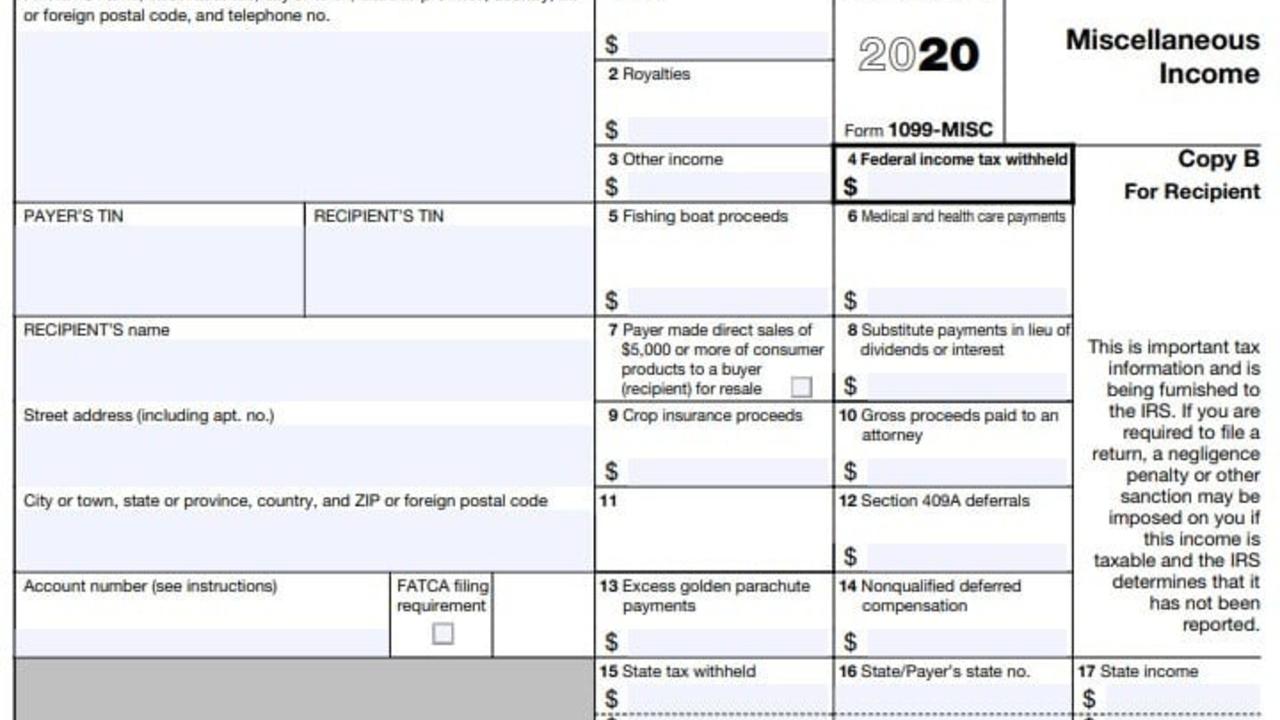

All About 1099s

The 1099-Misc form is used to report non-employee income payments. If you only have regular employees, you’ll be giving them each a W-2 instead.

As a small business owner, it’s very likely that you will receive and send a 1099-Misc form at the beginning of the new tax year. These forms are used to show the IRS what you paid any non-employee workers and report income you received from business contracts.

Much Ado About 1099s

As a small business owner, there are several conditions under which you are required by law to send 1099s to your vendors or contractors:

- You paid them 600 dollars or more for:

- Rent

- Non-employee services performed (a contractor)

- Other income payments

- Attorney payments

- Several other specific transactions

1099 forms are one of the ways that bookkeeping will help you stay on top of your tax season responsibilities!

Deadlines and Fees

You are required to send out 1099s by the deadline of January 31st (or since it's a Sunday in 2021 - Februar...

Ready, Set, Responsibility: Taxes, Taxes, Taxes

So Many Hats, So Little Time

Choosing the self-employed career path gives you a lot of personal power, and as we know, with great power comes great responsibility.

And one of those responsibilities is paying your taxes... But, just because you’ve chosen to shoulder additional responsibilities as a small business owner doesn’t mean that your stress level needs to rise just as much as your commitments have! You can learn how to cover all of your bases without stretching yourself to a breaking point.

Taxation Before Vacation

One of the reasons tax season can be so stressful is because we try to ignore it for 11 months of the year. Running a business really requires you to be mindful of what and when taxes must be paid, and also how your income affects what you owe.

When you are aware of your tax obligations all year long.... tax season will no longer be a seasonal stressor, instead it becomes a review of what you’ve already done (and saved). For some it can even mean more cash a...

Rediscover your WHY

We see you... small business owners

We know how demanding and stressful and hard it is to be self-employed.

We know how exhausting, frustrating and rewarding being your own boss can be. We also know that carrying around that stress can negatively impact all aspects of your life, not just your business!

And we know that when we're stressed.... how hard it is to stay inspired and focused on your passions and goals.

So we wanted to take a minute to share with you a stress reduction exercise that we do when we're feeling completely crushed by the overwhelming weight of the responsibilities of being self-employed...

So.... Whether you started your business 10 years ago, 10 months ago, or you've just come up with 10 ideas for your first business, we want to give you some strategies that work for us when we're feeling burned out and uninspired.

Whenever we're feeling like we can't keep up our head above water, it helps for us to go back to happier times.....

So, we want to take y...

The Simple Guide to Reconciling Your Bank Account

Why do we need to reconcile our bank & credit card accounts?

To keep it simple... Because we want to make sure the transactions reflected in your business records match the transactions recorded by your bank.

We use bank (and credit card) statements to double check that the accounts in our bookkeeping system, accurately reflect the transactions in the physical account they represent.

We use bank (and credit card) statements to double check that the accounts in our bookkeeping system, accurately reflect the transactions in the physical account they represent.

The use of systems like double-entry bookkeeping help ensure that you enter the correct numbers in the right places; bank reconciliations is the "bow" you tie on your account that lets you know that all of your transactions were recorded correctly, then they match the actual transactions and balances in your bank accounts to make sure you didn't make any mistakes.

Now you might be wondering, do ALL of my accounts need to be reconciled? The simple answer is no. But to help you know which accounts do need to reconciled, here's a quick refresher about how your accounts in your bookkeeping system ...