All About 1099s

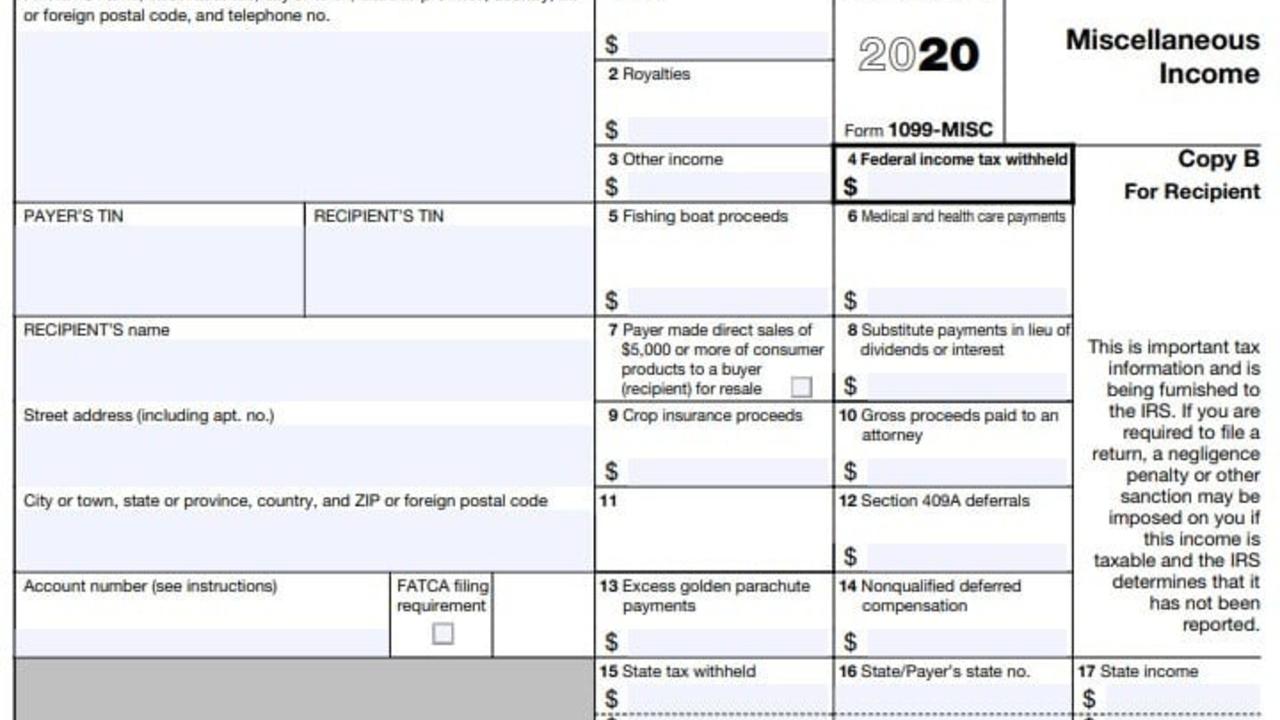

The 1099-Misc form is used to report non-employee income payments. If you only have regular employees, you’ll be giving them each a W-2 instead.

As a small business owner, it’s very likely that you will receive and send a 1099-Misc form at the beginning of the new tax year. These forms are used to show the IRS what you paid any non-employee workers and report income you received from business contracts.

Much Ado About 1099s

As a small business owner, there are several conditions under which you are required by law to send 1099s to your vendors or contractors:

- You paid them 600 dollars or more for:

- Rent

- Non-employee services performed (a contractor)

- Other income payments

- Attorney payments

- Several other specific transactions

1099 forms are one of the ways that bookkeeping will help you stay on top of your tax season responsibilities!

Deadlines and Fees

You are required to send out 1099s by the deadline of January 31st (or since it's a Sunday in 2021 - Februar...

Ready, Set, Responsibility: Taxes, Taxes, Taxes

So Many Hats, So Little Time

Choosing the self-employed career path gives you a lot of personal power, and as we know, with great power comes great responsibility.

And one of those responsibilities is paying your taxes... But, just because you’ve chosen to shoulder additional responsibilities as a small business owner doesn’t mean that your stress level needs to rise just as much as your commitments have! You can learn how to cover all of your bases without stretching yourself to a breaking point.

Taxation Before Vacation

One of the reasons tax season can be so stressful is because we try to ignore it for 11 months of the year. Running a business really requires you to be mindful of what and when taxes must be paid, and also how your income affects what you owe.

When you are aware of your tax obligations all year long.... tax season will no longer be a seasonal stressor, instead it becomes a review of what you’ve already done (and saved). For some it can even mean more cash a...

How Bookkeeping Makes Your Small Business More Profitable: Resources

Wow, we covered a lot of information in the last month. And for all that we did cover, there’s so much more information that we could have given you… but it would have been difficult to understand it all at once.

Profitability, in theory, is simple, but in practice, it takes time to understand and even more time (and plenty of energy) to apply your knowledge to your small business.

Let it never be said that we left you high and dry! We’ve got some wonderful resources that we use ourselves and also use with our relatively diverse set of small business clients.

Profitability Review

As we know by now, profitability isn’t just in the numbers, profitability is much more of a measure of your efficiency and ability to grow. More specifically, profitability is a measurement of how much profit you can make with a given set of resources and inputs.

We know that having a firm grasp on your expenses is the first step to understanding how your business is creating profit. You...

How Bookkeeping Makes Your Small Business More Profitable: Profits and Long Term Planning

So you’re making money and you’re happy… but what do you do next? Let’s discuss how you can use your net income to further your own profitability and lay the groundwork for long-term success!

Managing Profits and Savings

If you made it this far with no debt, you should not only pat yourself on the back, maybe you could tell us your secret - but for most small businesses, the first few years are more about staying afloat and learning the ins and outs of your new dream job.

Most of us have borrowed in some form or another to make sure we had the cash flow to maintain our business during its infancy. Now that we have secured net income and we understand how to make our services profitable - we can focus on managing our money efficiently!

If coming up with a Debt Reduction plan wasn’t part of your process for understanding your business expenses, than now is the time to do it! Pay from the highest interest rates first - these will also help free up your emotional energy so...

How Bookkeeping Makes Your Small Business More Profitable: Knowing your Customers and Increasing your Profitability

If you’ve been keeping up with our recent blogs you’ve already learned the foundation of small business profitability - your expenses and your income. Now it’s time to expand on this foundation to create sustainable changes in your business that lead to long term success.

It may seem like the above covers almost everything about making your small business more profitable, and we did cover a lot of very important things that will make you a smarter business owner, but there’s even more you can do to create an efficient and profitable business!

Knowing your Customers

Love, hate, or something in between, you need your customers for your small business to thrive!

When you’re just starting out, you’re thankful to have any clients, and you probably aren’t worried about retention or sales trends. But now, you’re smarter and you understand the money flowing in and out of your business - so it’s time to take your small business from successful to supreme.

So how do you go ab...

How Bookkeeping Makes Your Small Business More Profitable: Knowing your Income

Last week we talked about how understanding your small business expenses is a crucial component in making your business more profitable. Now we’re going to build on that with what we all really think of when we think of profitability, income.

The Expense and Income Relationship

In its most simple form, your income is all the money you bring in and your expenses are all the money that goes out. Your profit, or lack of, is the difference between these two numbers.

One common phrase that we hear and say frequently is “if you want to make money, you have to spend money.”

That doesn’t mean you just need to spend a certain amount of money, you need to make good decisions about what you spend your money on so those expense result in income for your small business.

Evaluating your expenses on a regular basis is one of the best ways for small business owners to stay on top of their financial plans and, most importantly, meet their income and growth goals. Without informed ...

How Bookkeeping Makes Your Small Business More Profitable: Knowing your Expenses

Keeping your Small Business books in good order is something that we’ve hammered home to our readers over the last year - but there’s more to good business than just keeping your books up to date, in fact, that’s only the beginning!

Good bookkeeping is the gateway to making your business go from good to amazing and it will allow you to turn small successes into huge gains.

So.... What is profitability?

Well it’s not just your top line that is important. That is to say, profitability is not measured only by your INCOME, it’s more than that.

Profit is an absolute number that is calculated by subtracting the total expenses from the total income.

So your profit margin is a solid number, while your profitability is a relative one. If this sounds more like math theory than business practice, don’t worry, stick with us and we'll explain...

In the most simple sense, profitability is a metric that a company will use to determine how well they use resources to generate revenue in excess...

Rediscover your WHY

We see you... small business owners

We know how demanding and stressful and hard it is to be self-employed.

We know how exhausting, frustrating and rewarding being your own boss can be. We also know that carrying around that stress can negatively impact all aspects of your life, not just your business!

And we know that when we're stressed.... how hard it is to stay inspired and focused on your passions and goals.

So we wanted to take a minute to share with you a stress reduction exercise that we do when we're feeling completely crushed by the overwhelming weight of the responsibilities of being self-employed...

So.... Whether you started your business 10 years ago, 10 months ago, or you've just come up with 10 ideas for your first business, we want to give you some strategies that work for us when we're feeling burned out and uninspired.

Whenever we're feeling like we can't keep up our head above water, it helps for us to go back to happier times.....

So, we want to take y...

Stay on top of your 2019 Tax Season

With the regular 2018 tax season over, most of us are breathing a sigh of relief, but it doesn’t mean that we can slack off! Staying on top of your taxes is a year long process, but it doesn’t have to be a stressful one.

Whether this tax season was a breeze for your small business, or it was traumatizing and you considered the white flag, we have a way for you to keep your taxes in line and out of mind!

Estimates

How do you know if you need to pay quarterly estimated taxes?

If you are a sole proprietor, S-Corp shareholder, or self employed, you generally have to pay quarterly taxes.

If you will owe $1000 dollars or more in taxes, you should definitely be paying quarterly tax estimates.

Why do we pay quarterly and not just once a year?

This cuts down on penalties from the IRS. It also allows your small business to plan accordingly for four smaller expenses instead of one large yearly expense.

Withholding

If you are an employee or if you have employees, anot...

Small Business Guide to Tax Savings

Tax season is many things, but no one describes it as fun. In our combined 25+ years of accounting and media experience we’ve seen the gamut of incredible and incredibly bad situations. Whether you’ve suffered from being unprepared, overwhelmed, or confused, we’ve been there with clients before, and we’re not going to let you go through it alone!

That's why we're going over some of the strategies we discuss in our free Tax Savings Guide.

Whatever the reason you dread tax time, we have ways that you can save yourself both headaches and money.

Tips to Save on Your Small Business Taxes:

Below are a couple of ways to help you save money on your small business tax return. Secure more deductions on your tax return and be less stressed in the process; it’s easier than you think! If you’re not familiar with the perks of good bookkeeping, you should check out this blog post breaking down exactly why it is so useful to your business.

Business vs Personal Expenses

It might see...