A Better Way to Start Tax Season

Most business owners think tax season starts in March or April. That’s why tax season ends up feeling chaotic. In reality, there are many things to be done in January that will set things up for a more manageable tax season.

What you do this month determines how much time, money, and energy taxes will take later.

Why January Is More Important Than You Think

January may feel disconnected from tax season, but for business owners it sets the tone for everything that follows. What you do this month often determines how smooth or stressful tax season becomes.

By the end of January, W-2s must be issued and 1099s filed for qualifying contractors and vendors. 1099s especially tend to take longer than expected due to missing or incorrect vendor info, and missing these deadlines leads to avoidable penalties.

January is also when your books should be finalized. Bank and credit card accounts reconciled, payroll and payroll taxes confirmed, asset and liability accounts reviewed, and loose ends from the year cleaned up. Having W-2s and 1099s completed usually forces this clarity.

If you hit January 31 with unfinished books, tax season quickly turns into a game of catch-up, making everything harder as deadlines pile up.

Your Accountant Is Thinking Ahead

When your accountant asks for documents early, it’s not pressure for pressure’s sake. It’s about protecting you from stress and limited options later.

For S Corps and partnerships, the real business tax season ends March 15. With personal and pass-through returns due April 15, the window for thoughtful decisions is short. That’s why February is the ideal time to file, and why January requests matter. There are a number of you that will have both a business tax return and a personal tax return so you may need to keep both deadlines top of mind.

Getting information in early gives you time to plan and make informed choices. Once March and April arrive, everything becomes reactive and flexibility disappears.

Extensions are available, March 15 extends to September 15 and April 15 to October 15. Just remember, extensions delay filing, not payment. Any tax owed is still due by the original deadline.

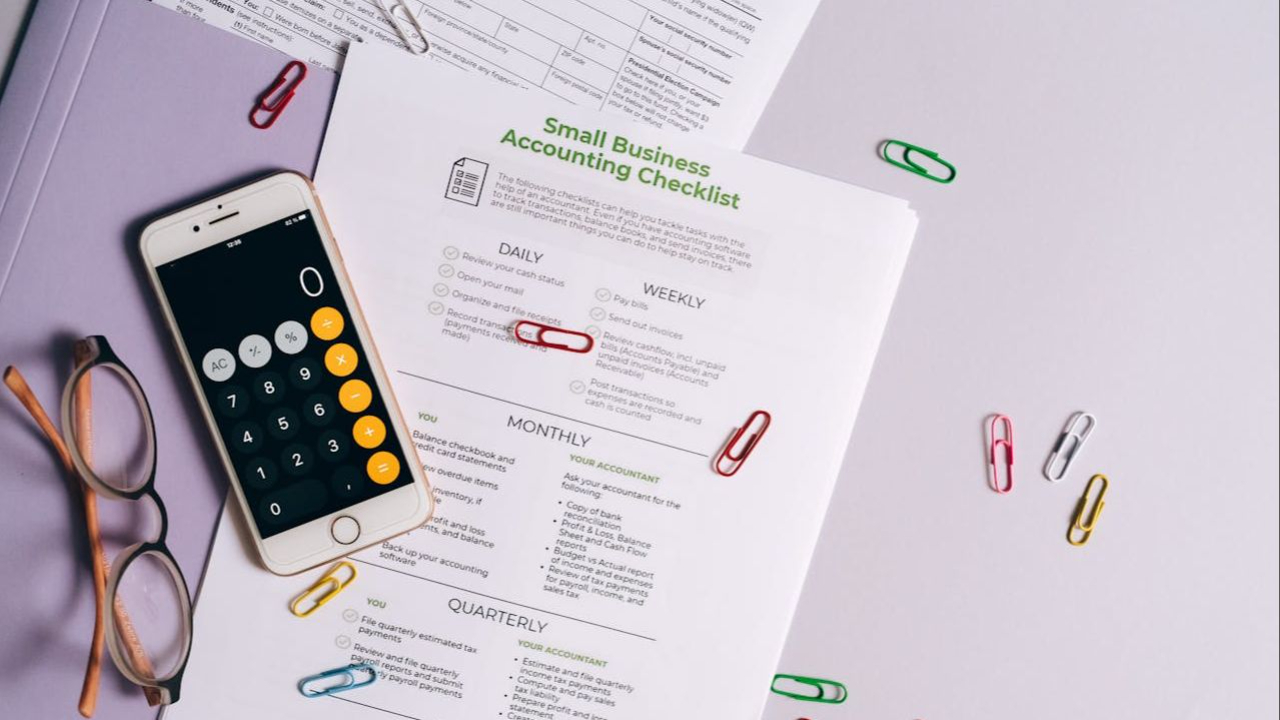

What “Tax Ready” Really Means

Being tax ready isn’t a feeling. It’s practical.

It means your books are reconciled, your numbers make sense, and everything is ready to hand off to a professional. Taxes aren’t the place to experiment or hope software gets it right.

Starting earlier gives you options. Waiting limits them.

The Bottom Line

January quietly decides how the rest of tax season will feel.

Handle the deadlines. Close the books. Share information with your accountant early. When you do, tax season becomes predictable instead of stressful.

That’s preparation, not luck.

At Bookkeeping Academy Online, we help business owners feel confident in their bookkeeping and understand their numbers. If you want support that makes finances feel clearer and less overwhelming, our 4 Weeks to Better Bookkeeping program is here to help.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.